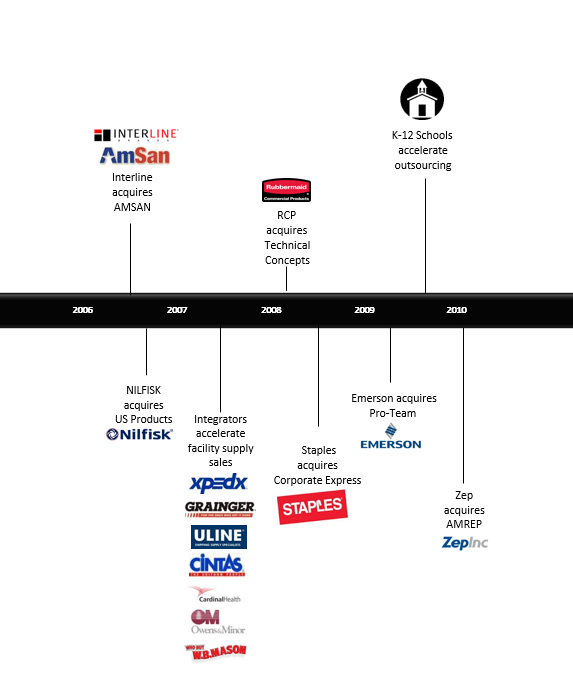

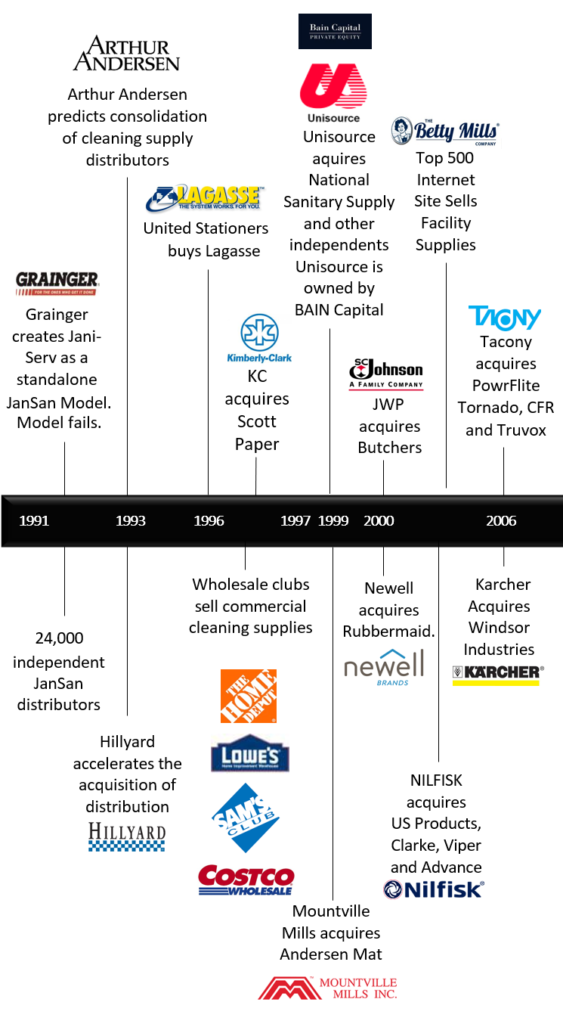

Cleaning Industry Timeline

Cleaning Industry Timeline

BradyIFS, a leading distributor of foodservice disposables and janitorial & sanitation products, has acquired Millennium Packaging & Distribution, which is headquartered in San Antonio, TX.

BradyIFS, a leading distributor of foodservice disposables and janitorial and sanitation (“JanSan”) products, is acquiring Fishman Supply Company (“Fishman”), with headquarters in Petaluma, CA, and Armstrong Paper Group (“Armstrong”), headquartered in Santa Rosa, CA. Both companies are market leaders in the distribution of foodservice disposables, JanSan, and facility supplies in Northern California.

Imperial Dade, (a Bain Capital portfolio company), today announced the acquisition of Mailender.

The Pearlman Group announced Tuesday that it has acquired Excel Cleaning and Restoration Supplies.

Fomento Económico Mexicano, (“FEMSA”) announced today that Envoy Solutions, FEMSA’s specialized distribution subsidiary in the United States, reached an agreement to acquire North Woods.

Superior Solutions has acquired Fuller Industries. Superior Solutions is a wholly-owned subsidiary of GDI Integrated Facility Services Inc., a Canadian-domiciled company division of GDI.

Bunzl gains safety and asset protection solutions distributor McCue Corp., which has operations in Massachusetts, Texas, California and the UK.

Aramsco, Inc. has acquired Penn Valley Chemical Company. Aramsco and its family of companies have been serving the needs of specialty contractors and other customers in diverse commercial markets in the United States, Puerto Rico and Canada. The Aramsco family of companies includes Interlink Supply, Aztec Financial and Safety Express

Fomento Económico Mexicano, (“FEMSA”) announced today that Envoy Solutions, FEMSA’s specialized distribution subsidiary in the United States, reached an agreement to acquire Penn Jersey Paper (PJP).

Imperial Dade (a Bain Capital portfolio company), today announced the acquisition of Empire Distributors (Rancho Cucamonga, CA)

Fomento Económico Mexicano, (“FEMSA”) announced today that Envoy Solutions, FEMSA’s specialized distribution subsidiary in the United States, reached an agreement to acquire Daycon Products Co. (“Daycon”).

ABM announced today that it has reached a definitive agreement to acquire Able Services, a leading facilities services company headquartered in San Francisco, in a cash transaction valued at $830 million.

Imperial Dade (a Bain Capital portfolio company), today announced the acquisition of Western Paper Distributors.

Imperial Dade (a Bain Capital portfolio company), today announced the acquisition of EBP Supply Company (“EBP”).

Imperial Dade (a Bain Capital portfolio company), today announced the acquisition of Moresco Distributing Company (“Moresco”).

Imperial Dade (a Bain Capital portfolio company), announced the acquisition of East Continental Supplies, LLC.

Today, Next-Gen Supply Group, Inc. announced that it has reached a definitive agreement to acquire Simplex Janitorial Supply.

Imperial Dade (a Bain Capital portfolio company) expands Service into Minnesota, enters into a definitive agreement to acquire Dalco Enterprises.

Brady and Individual Foodservice (IFS), announced the acquisition of Elkins Wholesale’s two Mississippi branches.

Imperial Dade (a Bain Capital portfolio company) announced the acquisition of Cosgrove Enterprises, Inc. Cosgrove is a leading distributor of janitorial supplies with six total facilities across Florida, Georgia, and Tennessee.

Incline Equity Partners a Pittsburgh-based private equity firm, is pleased to announce that it has made an investment in Jon-Don, a national value-added distributor of commercial supplies, equipment, and consumables to specialty contractors and in-house service providers.

GDI Integrated Facility Services Inc. announced that its U.S. subsidiary has acquired The BPAC Group, Inc. effective January 1, 2021.

BPAC is one of the largest and most respected mechanical services providers in New York State. With close to 200 employees, BP generated approximately USD$110 million in annual revenue in its most recent fiscal year.

Imperial Dade (Bain Capital Private Equity) has entered into a definitive agreement to acquire Industrial Soap Company. Headquartered in St. Louis, Missouri, Industrial Soap is a distributor of janitorial supplies owned and was operated by the Shapiro family.

Imperial Dade has entered into a definitive agreement to acquire Jackson Newell Paper Company of Meridian, Mississippi. The transaction represents the 31st acquisition for Imperial Dade.

Imperial Dade Enters into a Definitive Agreement to Acquire Paper Chemical Supply. This transaction represents Imperial Dade’s 30th Acquisition.

Brady, a full-line janitorial supply, equipment, and foodservice distributor, announces the acquisition of Kerr Paper & Supply in Little Rock, AR.

NW Synergy (NWS), the holding company led by distribution and logistics leader FEMSA and consisting of three regional leaders in the janitorial supply, packaging solutions, and specialty distribution (Waxie, North American, SWPlus), today announced the acquisition of Southeastern Paper Group (SEPG)

Bunzl recently completed the purchase of Snelling Paper & Sanitation Ltd, a Canadian business focused on the sale of cleaning and hygiene products and industrial and foodservice packaging.

Rocket Industrial announced its merger with Harder Corp of Madison, Wisconsin. Harder is a packaging and facility care provider serving customers throughout

the country from its Madison headquarters.

Brady Industries will merge with Individual FoodService (“IFS”), a portfolio company of Kelso & Company. This merger follows 3 months after IFS’s acquisition of Central Sanitary Supply.

NW Synergy (NWS), the combination of North American and WAXIE Sanitary Supply today announced

the acquisition of SWPlus.

Brady Industries, a portfolio company of A&M Capital Partners II, announced the acquisition of Topmost Chemical & Paper in Memphis, TN.

The Home Depot®, the world’s largest home improvement retailer, today announced it has entered into a definitive agreement to acquire HD Supply Holdings, Inc., a leading national distributor of maintenance, repair and operations (MRO) products in the multifamily and hospitality end markets.

The acquisition is expected to position The Home Depot as a premier provider in the MRO marketplace.

JanSan distributor Jon-Don has acquired Factory Cleaning Equipment Inc., Aurora, Illinois.

Jon-Don said the acquisition of FCE “marks a new phase of strategic growth for Jon-Don, as the company continues to expand its offerings within the jan-san, restoration equipment, and concrete surface prep and polishing industries.”

Vizient, Inc. today announces that it has signed an agreement under which it will acquire Intalere from Intermountain Healthcare, enhancing itself as a leader in the health care supply chain.

Brady Industries, a portfolio company of A&M Capital Partners II, announced the acquisition of Mission Janitorial & Abrasive Supplies based in San Diego, CA.

Imperial Dade, a Bain Capital Private Equity portfolio company, today announced the acquisition of P&R Paper Supply. The acquisition strengthens Imperial Dade’s West Coast presence while enhancing the company’s differentiated value proposition to customers in the region. The transaction represents the 28th acquisition for Imperial Dade.

The Carlyle Group announced it will acquire a majority stake in Minneapolis-based Victory Innovations, a maker of high-tech electrostatic sprayers used to disinfect offices, airplanes, schools, and other businesses.

Individual FoodService (“IFS”), a leading distributor of foodservice disposables and janitorial & sanitation (“JanSan”) products, has announced that it has acquired Central Sanitary Supply (“Central”), a leader in the distribution of janitorial, cleaning, and facility supplies headquartered in Modesto, California.

HD Supply Holdings Inc. announced it had agreed to sell the company’s Construction & Industrial – White Cap business to an affiliate of private equity firm CD&R for $2.9 billion.

HD Supply will consist of one core business, facilities Maintenance. The Facilities Maintenance business will continue to focus on providing MRO products, value-add services, and custom products to multifamily, hospitality, healthcare, and institutional property owners and managers, according to the company.

Brady Industries (“Brady”), a portfolio company of A&M Capital Partners II (“AMCP”), a middle-market private equity fund that is part of the Alvarez & Marsal Capital (“AMC”) platform, acquires the Fitch Co. in Baltimore, Maryland.

Hillyard, Inc. a family-owned manufacturer and nationwide distributor of cleaning solutions is pleased to announce an agreement in principle to acquire a 100% interest in House of Clean, Bozeman, Montana.

Bunzl Plc reported increased results for the first half period, and also announced that it has agreed to buy a US-based safety business and a flexible packaging distributor in Ireland.

- MCR Safety distributes a variety of largely own brand personal protection equipment and other safety products to distributors operating in a number of end-user markets.

- Abco Kovex is a distributor of flexible packaging based in Dublin, Ireland but with operations also in the UK and is principally engaged in the sale of items such as stretch film, polythene and paper packaging and pallet wrap to a variety of end-users in the food, construction, packaging, food service, and pharmaceutical sectors.

Brady Industries (“Brady”), a portfolio company of A&M Capital Partners II (“AMCP”), a middle-market private equity fund that is part of the Alvarez & Marsal Capital (“AMC”) platform, announced an expanded presence in the Colorado market by partnering with Colorado Springs Cleaning Supply Company. CSCSC will cease operations effective immediately and now work out of the Brady Denver branch.

Brady Industries (“Brady”), a portfolio company of A&M Capital Partners II (“AMCP”), a middle-market private equity fund that is part of the Alvarez & Marsal Capital (“AMC”) platform, acquired Campbell Paper Co., Fort Worth, Texas.

Genuine Parts Company announced today that it has completed the sale of its S.P. Richards operations through two separate transactions.

- S.P. Richards’ Core U.S. Operations Sold to Investor Group

- The Safety Zone and Impact Products Operations Sold to H.I.G. Capital

Brady, a full-line janitorial supply, equipment, and foodservice distributor, announces the acquisition of Maintenance Mart in Arizona.

Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA”) (NYSE: FMX) announced today that it has entered into definitive agreements with WAXIE Sanitary Supply and North American Corporation to form a new platform within the Jan-San, Packaging and Specialized distribution industry in the United States.

FEMSA has the majority controlling interest in the combined company.

Individual FoodService (“IFS”), a leading distributor of foodservice disposables and janitorial & sanitation (“JanSan”) products, has announced that it has acquired Cole Supply Company (“Cole”), a leader in the distribution of janitorial, cleaning and facility supplies based in Benicia, California.

Bunzl PLC, FTSE 100 distribution firm, said Thursday it has acquired US grocery-focused packaging firm Joshen Paper & Packaging Co Inc for an undisclosed sum.

Imperial Dade, a leading distributor of disposable foodservice and janitorial supplies, today announced the acquisition of American Paper & Plastics (“APP”).

Imperial Dade, a leading distributor of disposable foodservice and janitorial supplies, today announced the acquisition of Wagner Supply Company. The acquisition strengthens Imperial Dade’s Texas presence. The transaction represents the 26th acquisition for Imperial Dade.

Network Services Company (“Network”) and Strategic Market Alliance (“SMA”), leading providers of supply chain solutions in the janitorial, sanitation, foodservice and packaging industries, today announced the combination of the two companies, creating a global member-owned distribution organization.

The combined company will have over $22 billion in revenue with over 130 distributor members and over 900 locations in 50 countries.

Imperial Dade today announced the acquisition of Area Distributors. The acquisition strengthens Imperial Dade’s West Coast presence while enhancing the company’s differentiated value proposition to customers in the region.

Brady, a full-line janitorial supply, equipment and foodservice distributor, announces the acquisition of MASSCO headquartered in Wichita, KS.

Imperial Dade, a leading distributor of disposable food service and janitorial supplies, today announced the acquisition of Philip Rosenau Co., Inc. The combination of the two companies will further extend Imperial Dade’s reach into key Northeast markets and enhance the company’s offering to customers in the region.

Industrial distributor HD Supply Holdings, Inc. on Sept. 24 announced it plans to separate its Facilities Maintenance and Construction & Industrial businesses into two independent publicly traded companies. The separation is expected to be completed by the middle of fiscal year 2020, according to the company.

Ecolab Inc. has acquired the business of privately held Chemstar Corporation, a U.S.-based supplier of food safety and cleaning and sanitizing solutions focused on the grocery and food retail markets.

Amazon’s AmazonCommercial platform is an entry into jan/san products and could portend additional private-label product categories.

Berry Global Group Inc. is acquiring RPC Group plc in a blockbuster $4.37 billion, all-cash deal that trumps an earlier purchase attempt by a private equity firm.

RPC, with 153 manufacturing sites in 33 countries, brings about 25,000 employees to Berry’s existing workforce of about 23,000.

The move combines Berry’s concentration of business in North America with RPC’s concentration in Europe and provides a global plastic packaging platform for even more expansion in the future, CEO Tom Salmon said.

Performance Food Group Company (“PFG”) (NYSE: PFGC) today announced it has entered into a definitive agreement to acquire Reinhart Foodservice, L.L.C (“Reinhart”) from Reyes Holdings, L.L.C. in a transaction valued at $2.0 billion, or approximately $1.7 billion net of an estimated tax benefit to PFG of approximately $265 million. With annual net sales of over $6 billion, Reinhart is the second largest privately held foodservice distributor in the U.S. and is headquartered in Rosemont, IL.

TriMega Purchasing Association, Independent Suppliers Group and Pinnacle Affiliates, LLC announced that the boards of directors of all three organization have approved a Definitive Merger Agreement outlining the terms of a historic merger of the three organizations. Independent Suppliers Group will be the surviving organization and will be the name of the new organization.

Imperial Dade has acquired Strauss Paper Company, Inc. located in Port Chester, New York. This Imperial Dade’s twenty-second acquisition and further strengthens it’s presence in the Tri-State area

Imperial Dade today announced the acquisition of Mid Continent Paper & Distributing Co., Inc. The transaction represents the twenty-first acquisition for Imperial Dade, a leading national distributor of disposable food service and janitorial supplies.

Imperial Dade today announced the acquisition of Butler-Dearden Paper Service, Inc. (“Butler-Dearden”). The transaction represents the twentieth acquisition for Imperial Dade. Read the story.

Other Bain portfolio companies include Veritiv and Diversey.

Imperial Dade has acquired Edmar Cleaning Corp. (“Edmar”). The transaction represents the nineteenth acquisition for Imperial Dade, a leading national distributor of disposable food service and janitorial supplies, under the leadership of Robert and Jason Tillis, CEO and President of Imperial Dade, respectively.

HOSPECO, manufacturer of personal care, hygiene and cleaning products has acquired Nilodor, creator of proprietary odor control and odor neutralizing products for the facility care and pet care markets.

Nexstep Commercial Products, Exclusive Licensee of O-Cedar Brands, announced the purchase of Greenwood Mop & Broom, Inc. The purchase of Greenwood Mop & Broom is Nexstep’s seventh acquisition since August 1, 2003.

Imperial Dade has entered a Management Services and Inventory Purchase Agreement, effective immediately, to manage, oversee, and operate the Edison, New Jersey branch of Joshen Paper & Packaging (“Joshen”) through a three-month transitionary period and ultimately integrate operations into Imperial Dade’s existing Jersey City, NJ and Bordentown, NJ locations.

Brady Industries (“Brady”), a leading cleaning solutions provider, announced that it has sold a majority interest to Alvarez & Marsal Capital (“A&M Capital”), a middle-market private equity firm with a strategic association with Alvarez & Marsal (“A&M”).

Staples can now claim victory in its battle to acquire Essendant. Staples, Inc. and Essendant Inc. announced a definitive agreement under which an affiliate of Staples will acquire all of the outstanding shares of Essendant. In connection with the termination of the agreement to combine with Genuine Parts Company’s (GPC) S.P. Richards business, GPC is entitled to a $12 million break-up fee, which Staples is paying as part of its agreement with Essendant.

Amazon Business announced that it will reach $10 billion in annual sales this year, a little more than two years after reaching $1 billion in sales in its first year. Third-party sellers account for more than half of its revenue.

Americo is pleased to announce the acquisition of the strategic assets of U.S. Cocoa Mat (USCOA), a century old manufacturer of personalized Cocoa fiber doormats sold into the retail market.

Electrolux announced today it has divested its U.S.-based commercial and central vacuum cleaner businesses in North America, including the brands Sanitaire and BEAM. The decision is in line with the strategy of the business area Home Care & SDA to focus on global brands and product categories.

Staples Inc. announced that it has acquired HiTouch Business Services. HiTouch will now be a part of the Staples Business Advantage delivery organization. HiTouch’s marketplace website will continue to serve as an independent platform run by the HiTouch management team, and will help Staples’ growth into alternative distribution channels.

Imperial Dade has acquired American Osment. The transaction represents the seventeenth acquisition for Imperial Dade. Headquartered in Birmingham, Alabama, American Osment is a distributor of janitorial, sanitation,

foodservice and office supply products serving the northern Alabama region.

Home Depot plans to add 170 distribution facilities across the U.S. that will include direct fulfillment centers for next/same-day orders. The company’s goal is to reach 90 percent of the nation’s population in one day or less.

WB Mason has acquired OP and jan/san supplies company Consumers Interstate (CI).

The deal appears to be part of WB Mason’s US-wide strategy to accumulate market share and CI significantly boosts its reach in the New England and Eastern Connecticut area.

Imperial Dade has acquired Gulf Coast Paper Co., Inc. (“Gulf Coast Paper”). The transaction represents the sixteenth acquisition for Imperial Dade, a leading national distributor of disposable food service and janitorial supplies, under the leadership of Robert and Jason Tillis, CEO and President of Imperial Dade, respectively. Read the story.

Essendant (and Genuine Parts Co. announced Thursday that they have agreed to combine Essendant with Genuine Parts’ S.P. Richards business.

Montgomery Manufacturing expands with the acquisition of Garland based Carroll Company. Together Montgomery Manufacturing joined with Carroll Company

forms one the nation’s leading packagers of private branded cleaning and maintenance chemicals. Read the story.

Betco Corporation, Bowling Green, Ohio, acquired the assets of GMI Engineered Products including CRMX, 3-Step Concrete Polishing System, in January 2018.

Trivest Partners announced it has made an investment in Jon-Don, Inc. With the support of Trivest, the Company will be pursuing identified initiatives for continued organic growth while also actively pursuing strategic add-on acquisitions.

Carlisle Companies Incorporated announced the signing of a definitive agreement to sell Carlisle FoodService Products (CFS) to The Jordan Company of New York. The Jordan Company is a middle-market private equity firm.

Imperial-Dade recently acquired the following firms:

A current listing of Imperial Dade’s acquisitions is available here.

Golbon, a leader within the Foodservice distribution industry with the power of 200-plus independent distributors, has entered into a 5-year agreement to join AFFLINK effective March 1, 2018.

Blue Sage Capital has acquired Americo Manufacturing Company, a manufacturer of non-woven synthetic and natural fiber floor pads, hand pads, utility pads, floor matting, and other cleaning accessories.

Diversey announced it has entered into an agreement to acquire Twister Holding AB and its assets for an undisclosed amount from private equity firm Polaris.

Rexnord Corporation announced that it acquired World Dryer Corporation. World Dryer is a leading global manufacturer of commercial electric hand dryers with the largest worldwide installed product base. Zurn, a business within Rexnord’s Water Management platform.

Aramark announced two strategic and transformative acquisitions:

- Avendra to enhance purchasing capability and extend industry reach

- AmeriPride Services to expand scope and geography of uniforms business

ABM announced it has completed its acquisition of GCA Services Group for approximately $1.25 billion from affiliates of Thomas H. Lee Partners, L.P. and the Goldman Sachs Merchant Banking Division. GCA is a leading provider of facility services in the education and commercial industries.

Kellermeyer Bergensons Services, LLC (KBS), the largest provider of technology-enabled, integrated interior and exterior property services to retailers, grocers, and multi-site customers in North America, announced that it has purchased Varsity Facility Services.

In addition to Dade Paper, imperial’s has thus far acquired the following firms.

- Accommodation Mollen

- Peninsular Paper

- Burke Supply

- Goldman Paper

- Borox Paper

- Borda Products

- Center Moriches Paper

- Sifen-Berman Paper

- Wasserman Bag

Read about Imperial’s acquisition history.

AFFLINK has formed a strategic alliance with Independent Stationers, an industry-leading nationwide member-owned business products cooperative to launch Affiliate Membership programs that strengthen the dealers and distributors of each organization.

Lowe’s Companies, Inc. announced it has entered into a definitive agreement to acquire Maintenance Supply Headquarters, a leading distributor of maintenance, repair and operations (MRO) products

Sealed Air’s Diversey Care division today announced it has acquired the UVC disinfection portfolio of Cleveland-based Daylight Medical, a manufacturer of innovative medical devices. The portfolio acquired includes UVC disinfectant technologies designed to disinfect rooms, surfaces, non-critical equipment and devices.

Tennant Company announced that it has completed the acquisition of IP Cleaning and its subsidiaries (IPC Group) from private equity fund for $353 million (€330 million). The privately held IPC Group, based in Italy, designs and manufactures innovative professional cleaning equipment, tools and other solutions.

Cintas Corporation announced that it completed the previously announced acquisition of G&K Services, Inc.

Sealed Air Corporation today announced it has entered into a definitive agreement to sell its Diversey Care division and the food hygiene and cleaning business within its Food Care division to Bain Capital Private Equity, The transaction closed on 9/6/17.

Highview Capital, LLCand Victory Park Capital Advisors, LLC announced today the completion of the acquisition of substantially all of the assets of Katy Industries, Inc.

Buckeye International has 30 company-owned distributors nationwide. Read more.

The Carlisle Companies Incorporated announced the acquisition of San Jamar, Inc., a leading provider of universal dispensing systems and food safety products for food service and hygiene applications.

Ferguson has acquired Matera Paper Company, Inc. (Matera) in a stock transaction completed December 12, 2016. Matera is headquartered in San Antonio, TX.

SC Johnson announced that it is returning to the industrial and institutional (I&I) cleaning business.

Ecolab Inc. has sold the restroom cleaning business it acquired through the November 2015 acquisition of the U.S. operations of Swisher Hygiene Inc. to Enviro-Master International Franchise LLC. Ecolab continues to operate the warewashing, kitchen specialty, laundry and housekeeping cleaning and sanitizing products and services business of Swisher Hygiene, serving the foodservice, hospitality, retail and healthcare markets.

S.P. Richards Co., the office products group of Genuine Parts Co. Atlanta, GA, has agreed to acquire The Safety Zone LLC, Guilford, CT.

Excell Marketing & Procurement Group and NISSCO Restaurant Dealer Group today announced a strategic alliance. Now under a common umbrella, EMPG Holding Company, the two companies look to be a market leader supporting food service equipment and supplies dealers.

SCA and Wausau Paper Corp., a producer of away-from-home tissue products, have announced that SCA will acquire Wausau Paper for $10.25 per share, or around $513 million (approximately SEK 4.2 billion) in cash.

HP Products Corporation, a subsidiary of Ferguson Enterprises, Inc., acquired PCS Industries in an asset transaction completed on January 25, 2016. PCS Industries.

Ecolab Inc. announced that it has closed on its acquisition of the U.S. operations of hygiene and sanitizing solutions provider Swisher Hygiene Inc. Sales in 2014 for the operations included in the agreement were approximately $176 million.

Triple S Holdings will provide a new option for owner-principals (Member and Non-members) that are looking to exit their distribution businesses. Triple S Holdings will also look to assist current Triple S Members that wish to expand through acquisition or greenfield startups.

AFFLINK, a global leader in supply chain management and creator of the ELEVATE™ process, has announced a joint partnership with Pinnacle Affiliates, a 26-Member dealer group representing the largest independent office products distributors in the US.

CBRE Group, Inc. announced that it has closed the acquisition of Johnson Controls, Inc.’s Global Workplace Solutions business. Global Workplace Solutions is a market-leading provider of enterprise facilities management solutions for global corporations and other large occupiers of commercial real estate. Global Workplace Solutions had revenue of more than $3.0 billion in calendar year 2014.

The Home Depot, Atlanta, entered into a definitive agreement to acquire Jacksonville, Florida-based Interline Brands, Inc. Interline owns SupplyWorks, a recent consolidation of AmSan, CleanSource, JanPak, Trayco, and Sexauer.

United Stationers, a 93-year-old office-product company, is rebranding as Essendant, which combines “essentials” and “ascending” to reflect a unified brand.

GDI Integrated Facility Services Inc. Completes Arrangement and $150.4 Million Public Offering.

Cushman & Wakefield and DTZ have reached a definitive agreement to merge and are set to become one of the largest global real estate services companies.

Amazon announced the launch of Amazon Business, a new marketplace strictly for businesses. Amazon Business replaces AmazonSupply, Amazon’s current marketplace for industrial products and office supplies.

Zep Inc. and an affiliate of New Mountain Capital, L.L.C. (“New Mountain”) announced today that they have closed their previously announced acquisition of Zep in a transaction valued at approximately $692 million. The execution of a definitive merger agreement outlining the terms of the transaction was initially announced on April 8, 2015.

SC Johnson is pleased to announce that it has signed a binding offer to acquire Deb Group, a global industrial company focused on hygiene and skin care systems for the industrial, commercial, healthcare and food markets.

A private equity firm will acquire MedAssets and split the company in two, absorbing its revenue-cycle management business and selling its group purchasing and consulting business to the VHA-UHC Alliance, which is already one of the biggest GPO players in healthcare.

Ferguson Enterprises, Inc. (Ferguson), the largest plumbing wholesale distributor in the U.S., has acquired HP Products Corporation (HP Products). HP Products

S. P. Richards Company, the Company’s Office Products Group, has entered into a definitive agreement to acquire Impact Products, LLC (“Impact”). Consummation of the transaction is expected on July 1, 2014. Impact Products is a leading value-added provider of facility, janitorial and safety supplies serving North America. The Company expects the acquired business to generate approximately $85 million in annual revenues.

xpedx, a business of International Paper (NYSE: IP) and Unisource Worldwide, Inc., today announced that they have chosen the name Veritiv for the leading distribution solutions company that will be created upon completion of their merger. The name Veritiv comes from the roots of three words: “verity”, meaning true, and “active” and “connective”.

GOJO Industries announced today the acquisition of Laboratoires Prodene Klint. The two companies are joining forces to advance a shared vision of global leadership. Based in France, Prodene Klint specializes in professional hygiene, cosmetics and disinfectant products.

Bunzl plc, the international distribution and outsourcing Group, today announces that it has acquired Wesclean Equipment & Cleaning Supplies Ltd in Canada. Wesclean operates from 13 locations throughout Western Canada.

GCA Services Group, Inc. and Blackstone (NYSE: BX) today announced a definitive agreement under which a fund managed by Blackstone on behalf of its private equity investors, Blackstone Capital Partners V, L.P. (collectively with its affiliates, “Blackstone”), will acquire GCA Services Group, a leading facility services company in the U.S., from Nautic Partners, L.L.C. and other minority shareholders.

Interline Brands, a distributor of repair products for professional contractors, agreed on Tuesday to sell itself to the private equity arm of Goldman Sachs and P2 Capital Partners for about $1.1 billion, including debt.

In an announcement that is sure to gain the attention of industrial distributors doing business online, Internet powerhouse Amazon.com announced the release of a Beta Web site called AmazonSupply.

The new Web site is dedicated to offering a broad selection of parts and supplies to business, industrial, scientific and commercial customers at competitive prices.

Brady Industries has acquired the resort laundry division of Southern Nevada commercial laundry service supplier Mission Industries.

Sealed Air Corporation (“Sealed Air”) (NYSE: SEE) and Diversey Holdings, Inc. (“Diversey”) announced that they have entered into a definitive agreement under which Sealed Air will acquire Diversey, a leading solutions provider to the global cleaning and sanitization market, in a transaction valued at $4.3 billion. The transaction is expected to be completed in 2011 and is expected to be accretive to earnings in the first full year following completion.